Swing low and swing high PDF provides a structured explanation of how price movements form turning points that signal potential opportunities in the market. This ebook is suitable for traders in all markets: currencies, stocks, and more…

Introduction

Understanding market swings is one of the most important skills for traders who want to succeed in technical analysis. The Swing low and swing high PDF provides a structured explanation of how price movements form turning points that signal potential opportunities in the market. By studying these highs and lows, traders can better recognize the start of an uptrend, a downtrend, or even a sideways range.

This ebook explains in detail how swing highs occur when rising prices reverse to the downside, and how swing lows appear when falling prices turn back upward. With clear examples and diagrams, readers will learn how to spot these critical levels, confirm them with surrounding candles, and use them to define market trends.

Beyond definitions, the Swing low and swing high PDF highlights how these turning points serve as natural areas of support and resistance. Identifying them accurately allows traders to set precise entries, exits, and stop-loss levels, improving both risk management and confidence.

Whether you are new to trading or aiming to refine your chart-reading skills, this guide offers practical insights into one of the core building blocks of technical analysis. It is a concise yet powerful resource for anyone looking to improve trading decisions using swing highs and swing lows.

______

Trend Direction

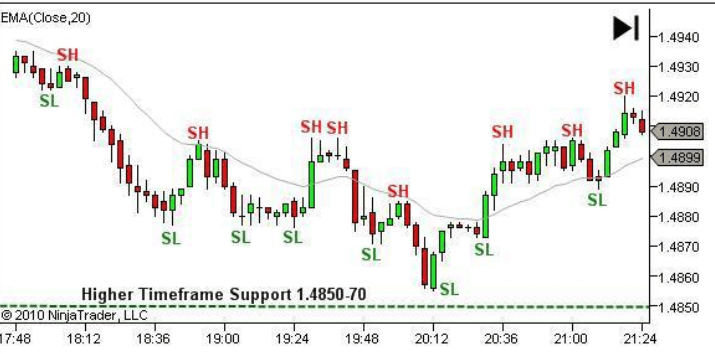

Price movement between these swing H/L will form into trends; either as an uptrend, downtrend

or a sideways trend (trading range).

Uptrend – Definition

An uptrend comprises a repeating sequence of:

1) An upward extension

2) A swing high

3) A downward pullback

4) A swing low

This is demonstrated below in figure 3.34, where you‟ll also notice a few other key observations:

The price extensions are longer than the pullbacks.

Extensions will break above previous swing high, reaching new price highs for that trend.

Pullbacks will not break below previous swing lows.

This results in a series of higher swing highs and higher swing lows.