Liquidity Concepts For Smart Money Concepts [PDF] explains how liquidity zones are created, why they attract price, and how professional traders exploit them to gain an edge.

Introduction

Liquidity is the fuel that drives every market move, and understanding how it works is essential for traders who want to think like institutions. This Liquidity Concepts For Smart Money Concepts PDF explains how liquidity zones are created, why they attract price, and how professional traders exploit them to gain an edge. Instead of relying on retail strategies that often fall into manipulation traps, this guide equips you with the tools to trade alongside smart money.

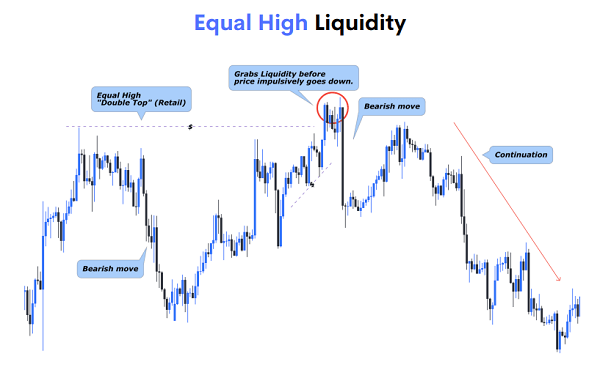

Inside, you’ll discover the main types of liquidity, including trendline liquidity, range liquidity, equal highs, and equal lows. Each section breaks down how retail traders unknowingly create liquidity pools and how these areas are targeted before major price moves occur. The ebook also explores how concepts like stop hunts, liquidity grabs, and market manipulation play out in real-world charts, giving you a clearer perspective on market psychology.

What makes this Liquidity Concepts For Smart Money Concepts PDF especially valuable is its practical approach. Each idea is explained simply, with examples that can be applied across forex, stocks, and other markets. By mastering liquidity concepts, you’ll learn to anticipate institutional moves, avoid common retail mistakes, and build trading strategies that align with the true forces driving the market.

Excerpts

What is Liquidity?

The markets need to generate liquidity in order to move up or

down. If liquidity isn’t already there, then it will will be created.

Retail basics are like support and resistance, double top, double

bottom and Trendlines. These areas are mostly generates liquidity

to the markets. We expect the price to be manipulated at and

around these areas.

Different types of Liquidity

Trendline Liquidity

Range (Support & Resistance) Liquidity

Equal Lows

Equal Highs

Trendline Liquidity

Retail traders are taught to buy at a Trendline or wait for the break out of that trendline to go short and vice versa.

With this it creates a lot of liquidity at these areas that the markets will manipulate to grab liquidity before a larger move in the markets can take