Liquidity Based Trading Strategy [PDF]- Understanding liquidity is the cornerstone of professional trading. This ebook introduces you to a smart money approach that focuses on how institutions use liquidity zones to enter and exit the market.

Introduction

Understanding liquidity is the cornerstone of professional trading. This Liquidity Based Trading Strategy PDF introduces you to a smart money approach that focuses on how institutions use liquidity zones to enter and exit the market. By recognizing where stop-losses are placed—above equal highs or below equal lows—you’ll learn to anticipate price movements instead of being caught in retail traps.

Inside, the guide breaks down core concepts such as buyside liquidity (BSL) and sellside liquidity (SSL), showing you how these areas become magnets for price action. You’ll also discover how to identify key levels like previous day highs/lows, liquidity sweeps, and fake breakouts. Step-by-step, the ebook explains how to wait for liquidity grabs, confirm rejection signals, and execute trades with precision.

What makes this Liquidity Based Trading Strategy PDF especially practical is its structured trading plan. From marking zones on higher timeframes to refining entries on lower ones, the strategy offers a repeatable process for both intraday and swing trading. Real-world examples, supported by clear rules, demonstrate how liquidity drives market behavior and how you can use it to your advantage.

Whether you’re new to smart money concepts or looking to refine your edge, this resource equips you with actionable methods to trade alongside institutional flows with confidence.

Excerpts

Absolutely! Here’s a complete guide to Liquidity-Based Trading, explained clearly and

practically for your trading journey:

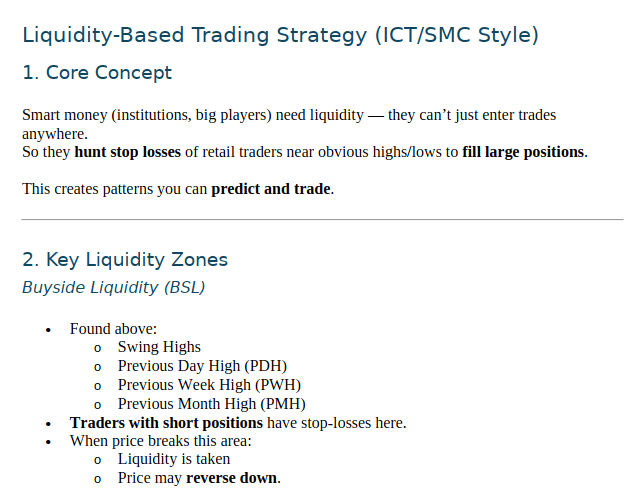

Liquidity-Based Trading Strategy (ICT/SMC Style)

1. Core Concept

Smart money (institutions, big players) need liquidity — they can’t just enter trades

anywhere.

So they hunt stop losses of retail traders near obvious highs/lows to fill large positions.

This creates patterns you can predict and trade.

2. Key Liquidity Zones

Buyside Liquidity (BSL)

Found above:

o Swing Highs

o Previous Day High (PDH)

o Previous Week High (PWH)

o Previous Month High (PMH)

Traders with short positions have stop-losses here.

When price breaks this area:

o Liquidity is taken

o Price may reverse down.

Sellside Liquidity (SSL)

Found below:

o Swing Lows

o Previous Day Low (PDL)

o Previous Week Low (PWL)

o Previous Month Low (PML)

Traders with long positions have stop-losses here.

When price breaks this area:

o Liquidity is taken

o Price may reverse up.

3. Timeframes to Use

Scalping: 15m, 30m, 1H

Intraday/Swing: 1H, 4H, Daily, Weekly

Start from higher timeframes to mark key levels, then drop to lower timeframe for

entries.