Mastering Liquidity Your Key To Successful Trading [PDF] is designed to give traders a clear framework for spotting liquidity levels, understanding how they drive price movements, and applying strategies that align with institutional flows. By learning where liquidity rests, you can anticipate stop hunts, avoid retail traps, and trade with more confidence.

Introduction

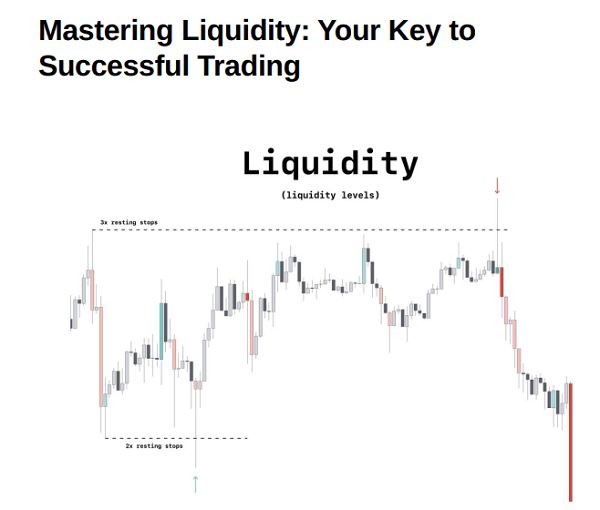

Liquidity is the lifeblood of every financial market, and knowing how to identify and use it can transform your trading results. This Mastering Liquidity PDF is designed to give traders a clear framework for spotting liquidity levels, understanding how they drive price movements, and applying strategies that align with institutional flows. By learning where liquidity rests, you can anticipate stop hunts, avoid retail traps, and trade with more confidence.

Inside, the guide covers essential topics such as daily highs and lows, trend liquidity, pivot rays, and session candles. You’ll also explore advanced tools like TPO profiles and custom pivot line indicators, which help reveal hidden liquidity zones. Each section breaks down these concepts step by step, showing you how to integrate them into your trading system for better timing and precision.

Excerpts

In this detailed PDF guide, we will explore the strategies and tools used to identify and harness liquidity in

your trading endeavors. Liquidity, the lifeblood of financial markets, plays a pivotal role in executing successful

trades. Join us as we delve into the following key aspects:

1. Discovering Favorite Liquidity Levels: Learn the art of identifying your preferred liquidity levels within

the market. Uncover the strategies that can help you navigate the ebb and flow of assets with precision.

2. Leveraging Indicators: Explore the world of trading indicators designed to assist you in pinpointing

optimal liquidity zones. Gain insights into which indicators can be your trusted companions in making

informed trading decisions.

3. Session Candles: Understand the significance of session candles in gauging liquidity. We’ll walk you

through how these candles can provide valuable clues about market sentiment.

4. Daily Highs and Lows: Dive into the concept of daily highs and lows and how they relate to liquidity.

Discover how these levels can serve as reference points in your trading analysis.

5. Pivot Rays: Delve into the powerful tool of pivot rays. Learn how to use them to map out pivotal areas of

liquidity and price action.

6. Preferred Timeframes: Uncover the importance of selecting the right timeframes to match your trading

style. We’ll guide you on how to synchronize your timeframe preferences with liquidity-seeking strategies.

Whether you’re a novice trader looking to understand the fundamentals or an experienced trader seeking to

refine your techniques, this PDF guide will equip you with the knowledge and insights to navigate the complex

world of liquidity in trading.

Prepare to unlock the hidden potential of liquidity, enhance your trading acumen, and take your strategies to

the next level.