Price Action Trading [PDF] provides a complete introduction to the principles of trading with pure price data, making it ideal for both beginners and experienced traders who want to sharpen their skills.

Introduction

Price action is one of the most effective ways to read the markets because it focuses directly on what price is doing without relying on lagging indicators. This Price Action Trading PDF provides a complete introduction to the principles of trading with pure price data, making it ideal for both beginners and experienced traders who want to sharpen their skills.

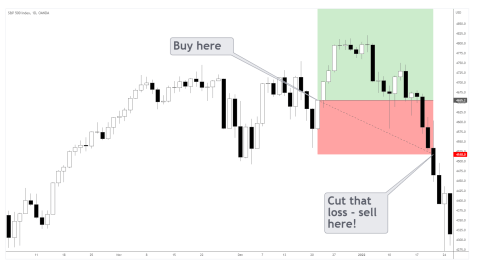

Inside, the ebook explains the building blocks of price action, including candlestick structures, contraction and expansion phases, and the role of supply and demand zones. You’ll learn how to identify key support and resistance levels, recognize reversal and continuation patterns, and apply breakout and rebound setups with greater accuracy. Each concept is broken down into simple, actionable steps supported by clear examples from real charts.

What makes this Price Action Trading PDF especially valuable is its focus on risk management and trader psychology. It emphasizes how price action can reduce randomness in decision-making, helping traders control losses while letting winners run. By combining multi-timeframe analysis, volume confirmation, and practical strategies, this guide equips you with the tools to trade more consistently. Whether you trade forex, stocks, or indices, mastering price action will give you the confidence to interpret market moves with clarity and precision.

Excerpts

Table of Contents

Does price action trading really work?…………………………………………………………………………………… 2

Is price action better than indicators?……………………………………………………………………………………. 3

Do pro traders use indicators?………………………………………………………………………………………………. 4

Which trading strategy is the best? ……………………………………………………………………………………….. 4

Why does price “act”?……………………………………………………………………………………………………………… 4

Market players ……………………………………………………………………………………………………………………. 5

Limit players ……………………………………………………………………………………………………………………….. 6

Price action – building blocks……………………………………………………………………………………………………. 8

Contraction and expansion candles……………………………………………………………………………………….. 8

Supply and demand zones aka resistance and support……………………………………………………………. 9

Two camps of setups…………………………………………………………………………………………………………..14

Pro tip: volume confirmation……………………………………………………………………………………………….17

Multi timeframe analysis …………………………………………………………………………………………………….17

Final words ……………………………………………………………………………………………………………………………20

Price Action Trading

Before we delve into price action trading features, have you ever pondered the meaning of price?

Market prices are more than just numbers and trajectories formed by their change.

Those flickering digits on the screen actually carry an enormous weight of information!

According to the renowned economist and Nobel laureate Milton Friedman, prices communicate with

society in three ways.

Prices transmit information, incentivize resource users to be guided by the price data, and encourage

the resource owners to follow such information.

Pretty complex, isn’t it?

The point is there’s a depth of insight into why the prices are where they are.

Notice that we mentioned resource users and owners – these smell like fundamentals.

You can’t really argue that price analysis is one thing and assessment of the real economy is another!

Although, it’s people who form prices, and we’re not so precise sometimes.

Considering all of the above, think about what price action trading really is.

Investors look at the “cold data,” place their bets, and form prices.

Then others look at how those bets impacted the price – its “action.”

By interpreting the price action, we can find quality trading opportunities.

So, let’s learn to interpret right!

Does price action trading really work?

The financial markets are always uncertain.

We’re talking about millions of participants with their countless individual market perceptions.

What can we control in such an environment?

A few things, with the risk laying right at the center.

The main strength of the price action is helping to limit the risks.