The Aroon Indicator MT4 is a versatile technical tool designed for forex traders to identify trend strength, direction, and potential reversals on MetaTrader 4. Developed by Tushar Chande in 1995, it measures the time elapsed since recent highs and lows, helping traders navigate trending and ranging markets. Its straightforward signals make it an excellent choice for both novice and experienced MT4 users.

Three Key Uses

- Trend Strength Assessment: The Aroon Indicator MT4 quantifies trend momentum, with high Aroon-Up or Aroon-Down values (above 70) indicating strong bullish or bearish trends, respectively.

- Trend Reversal Signals: Crossovers between Aroon-Up and Aroon-Down lines signal potential trend changes, enabling traders to anticipate market shifts.

- Consolidation Detection: Parallel or low values (below 30) for both lines indicate a ranging market, helping traders avoid false signals during sideways movement.

What is the Aroon Indicator MT4?

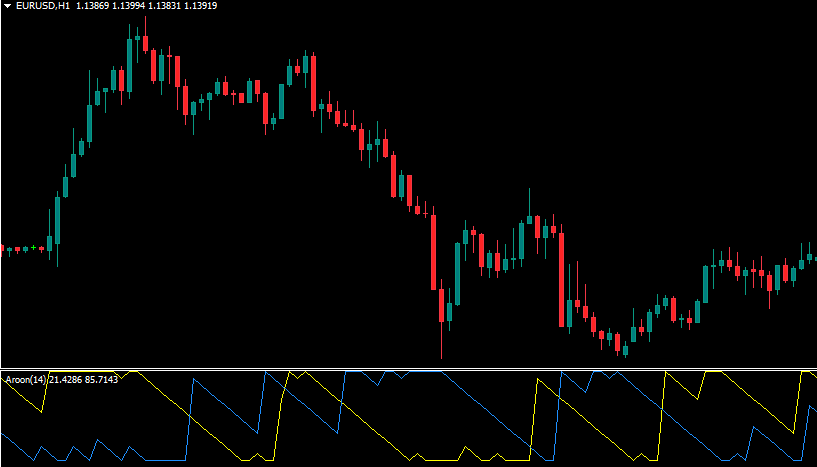

The Aroon Indicator MT4 consists of two lines: Aroon-Up and Aroon-Down, plotted in a separate MT4 window and ranging from 0 to 100. Aroon-Up measures the time since the highest high over a specified period (default 14), while Aroon-Down tracks the time since the lowest low. Calculated as percentages, these lines reflect trend strength and direction. For example, Aroon-Up = [(Period – Days Since Highest High) / Period] x 100. High values near 100 indicate recent highs or lows, signaling strong trends, while values below 30 suggest weak trends or consolidation. The indicator’s name, derived from the Sanskrit term “Dawn’s Early Light,” underscores its ability to spot emerging trends.

How to Use

To use the Aroon Indicator MT4, download the .ex4 or .mq4 file and install it in the MT4 “Indicators” folder. Apply it to a chart and adjust the period (default 14) to match your trading style. Here’s a practical guide:

- Bullish Trend: When Aroon-Up crosses above Aroon-Down and rises above 70, with Aroon-Down below 30, consider a buy trade. Confirm with price action or support levels.

- Bearish Trend: When Aroon-Down crosses above Aroon-Up and exceeds 70, with Aroon-Up below 30, evaluate a sell trade, validated by resistance or bearish patterns.

- Consolidation: If both lines are below 50 and moving parallel, avoid trend-following trades and focus on range-bound strategies or wait for a breakout.

Combine with indicators like MACD or RSI on MT4 to filter false signals, especially in choppy markets. Test on pairs like EUR/USD or GBP/JPY using timeframes like H1 or H4 for reliable results.

Benefits of the Aroon Indicator MT4

The Aroon Indicator MT4 is easy to interpret, with clear crossover and value-based signals, making it accessible for beginners. Its time-based approach, focusing on periods since highs/lows, complements price-based indicators, enhancing analysis. The indicator excels in trending markets and is adaptable across timeframes, from M15 for scalping to D1 for swing trading. Customizable settings allow alignment with specific strategies, and its no-repaint feature ensures signal consistency. However, it may produce false signals in volatile, ranging markets, so pairing it with tools like Moving Averages or Bollinger Bands improves accuracy. Its free availability and lightweight design make it a practical addition to any MT4 setup.

Conclusion

The Aroon Indicator MT4 is a powerful tool for forex traders seeking to master trend analysis and market timing. Its ability to assess trend strength, signal reversals, and detect consolidation makes it invaluable for navigating dynamic forex markets. Download the Aroon Indicator MT4 today to elevate your trading precision, but always use it with complementary tools and sound risk management for optimal results.