Liquidity in The Forex Market [PDF] provides traders with a clear understanding of what liquidity means, how it is created, and why it plays such an important role in trading outcomes. By mastering this concept, traders can better anticipate market behavior and avoid common pitfalls.

Introduction

Liquidity is one of the key factors that determine how smoothly the forex market operates. The Liquidity in The Forex Market PDF provides traders with a clear understanding of what liquidity means, how it is created, and why it plays such an important role in trading outcomes. By mastering this concept, traders can better anticipate market behavior and avoid common pitfalls.

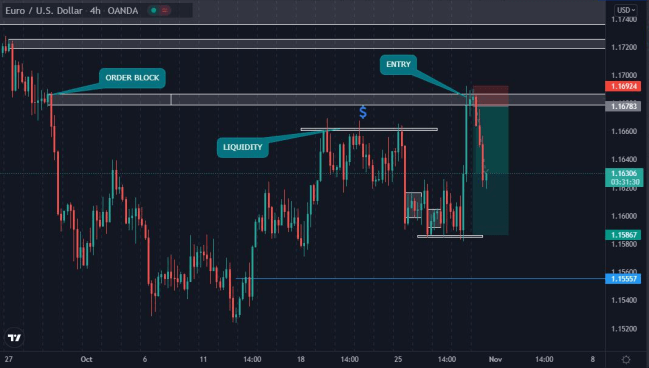

This ebook explains the dynamics of normal liquidity during major sessions and highlights how the Asian session creates unique opportunities for liquidity grabs. It also details how smart money and market makers use order blocks to target zones filled with stop losses, triggering sharp price movements that often confuse retail traders. Through practical illustrations, readers will learn how to identify liquidity zones around support and resistance and how to position themselves to take advantage of these setups.

The Liquidity in The Forex Market PDF also emphasizes the importance of risk management, showing why precise stop losses and proper timing are essential when trading liquidity events. By combining theory with real trading examples, this guide helps traders avoid becoming the liquidity themselves and instead use it as an advantage.

Whether you are a beginner or an advanced trader, this resource offers actionable strategies to understand and trade liquidity effectively.

Excerpts

In this E-book, I will explain the following:

Normal liquidity in the forex market.

Asian liquidity session and how to know the first direction for liquidity grabs.

Yes and Amen! I am here humble to present to you about liquidity in the forex

market. I wasn’t planning on writing another E-book on liquidity but I got lots of

requests concerning the issue of liquidity in the market. The other E-book I wrote was

only explaining about order blocks, Wyckoff and the likes. Without further ado, let’s

go straight to the contents of this book.

WHat iS liQuiditY?

Liquidity in Forex Trading Term used to describe a market where there are lots of

buyers and sellers generating a great deal of volume.

From what we have here, I would say liquidity is where there is a lot of money and

most people are looking to take trades. If this type of situation happens then we know

millions of people are targeting to make profit from. Then a lot of stop losses and

entries will be at that liquidity zone. We can also say liquidity means a lot of stop

losses and if there will be a lot of stop losses in a particular zone, then smart money

will look for where there is a majority of stop losses, take them out before moving the

initial direction.

In this book I will be showing us how the market makers and smart money

algorithms use order blocks to take out liquidity in this market. Once market takes out

liquidity, it takes it out sharply and doesn’t want the majority to take or place trades

once they are grabbing liquidity, that’s why you see aggressive moves or spikes while

they are grabbing liquidity in the market and you are wondering if there was news in

the market or the market just wanted to move like that. That’s Smart money for you!

normal liQuiditY in tHe ForeX marKet.

Like I’ve stated before, I will first talk about the normal liquidity in the market and

we move to the Asian session liquidity. I will make this E-book short but detailed on

how to trade liquidity grab.

“IF YOU CANNOT SPOT THE LIQUIDITY, THEN YOU ARE THE LIQUIDITY”

What’s the meaning of this? From what I just quoted, if you don’t know where the

liquidity is in the forex market, you end up getting your stop losses hit due to the fact

that you are placing trades where there is going to be a lot of volume that would take

out your stop loss.

HoW do We Spot liduiditY?

We spot liquidity when we can see that there are obvious buyers and sellers in the

market. How do we know where the obvious buyers and sellers are?? We spot the

buyers and sellers simply by identifying the obvious support and resistance areas in

the market.