Master Liquidity in Forex Trading [PDF] offers traders a practical guide to understanding how liquidity works, where it exists, and how it is exploited by market makers. By mastering these concepts, you can avoid becoming the liquidity and instead trade in alignment with institutional flows.

Introduction

Liquidity is the driving force behind every price movement in the foreign exchange market. This Master Liquidity in Forex Trading PDF offers traders a practical guide to understanding how liquidity works, where it exists, and how it is exploited by market makers. By mastering these concepts, you can avoid becoming the liquidity and instead trade in alignment with institutional flows.

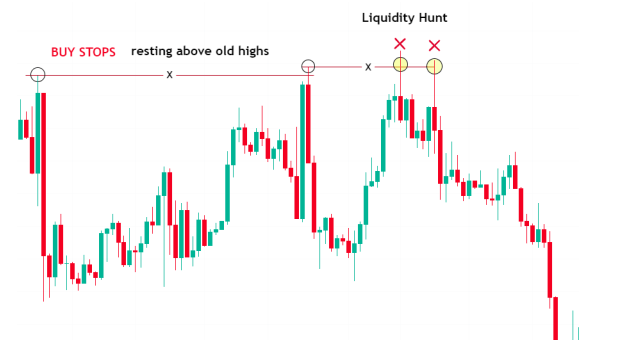

Inside, the ebook explains the meaning of liquidity in forex trading, showing how buy-side and sell-side liquidity zones are formed around equal highs, equal lows, and key market levels. You’ll also learn how stop orders—buy stops above highs and sell stops below lows—create liquidity pools that are targeted in liquidity hunts. With detailed examples and illustrations, the guide demonstrates how price sweeps these levels before moving in the opposite direction, a process that often confuses retail traders.

What makes this Master Liquidity in Forex Trading PDF especially valuable is its simple yet powerful approach. The content is structured as a step-by-step guide, making it accessible to beginners while still offering depth for experienced traders. By studying these concepts, you will gain the skills to identify liquidity traps, follow the flow of smart money, and build more consistent trading strategies in the forex market.

Excerpts

Do you want to understand the term liquidity in forex trading?

In this article we will teach you the meaning and identification of liquidity in forex market.

After studying this article and practicing in the markets, you will be able to spot resting

liquidity in the market like a pro.

Now lets begin with defining the term liquidity in trading.

What is Liquidity in Forex Trading?

The word Liquidity itself means convertible to cash.

Liquidity of an asset is marked high if it can easily be sold and converted to cash.

In forex trading liquidity means availability of willing buyers and sellers at market price.

Because if someone wants to buy an asset there should be a seller of that asset and

conversely for a seller there should be a buyer.

Liquidity makes it easy for the market to operate effectively.

Liquidity in forex market is measured by the volume of active or pending orders in the

market.

And the market makers mostly try to hunt the liquidity of retail traders.

Types of Liquidity in Trading?

As there are two types of orders in trading that are buy and sell.

So liquidity is also of two types which are explained below.

Buy Side Liquidity according to the inner circle trader (ICT) is the volume of pending

buy orders (Buy Stops).

When traders execute a sell order mostly they want to protect it with a buy order in case

price moves against them.

So they use buy stop to protect their capital and hedge against loss.

Any one selling at a price level will have a buy stop placed above that price.

So buy stops rest above highs and that is why the old highs like weeks high ,days high

or equal highs are termed as buy side liquidity.

And the market makers try to grab these highs to convert the pending orders into

market orders and then move the market against them.

In this way they make profit from retail traders and this is termed as Liquidity Hunt.